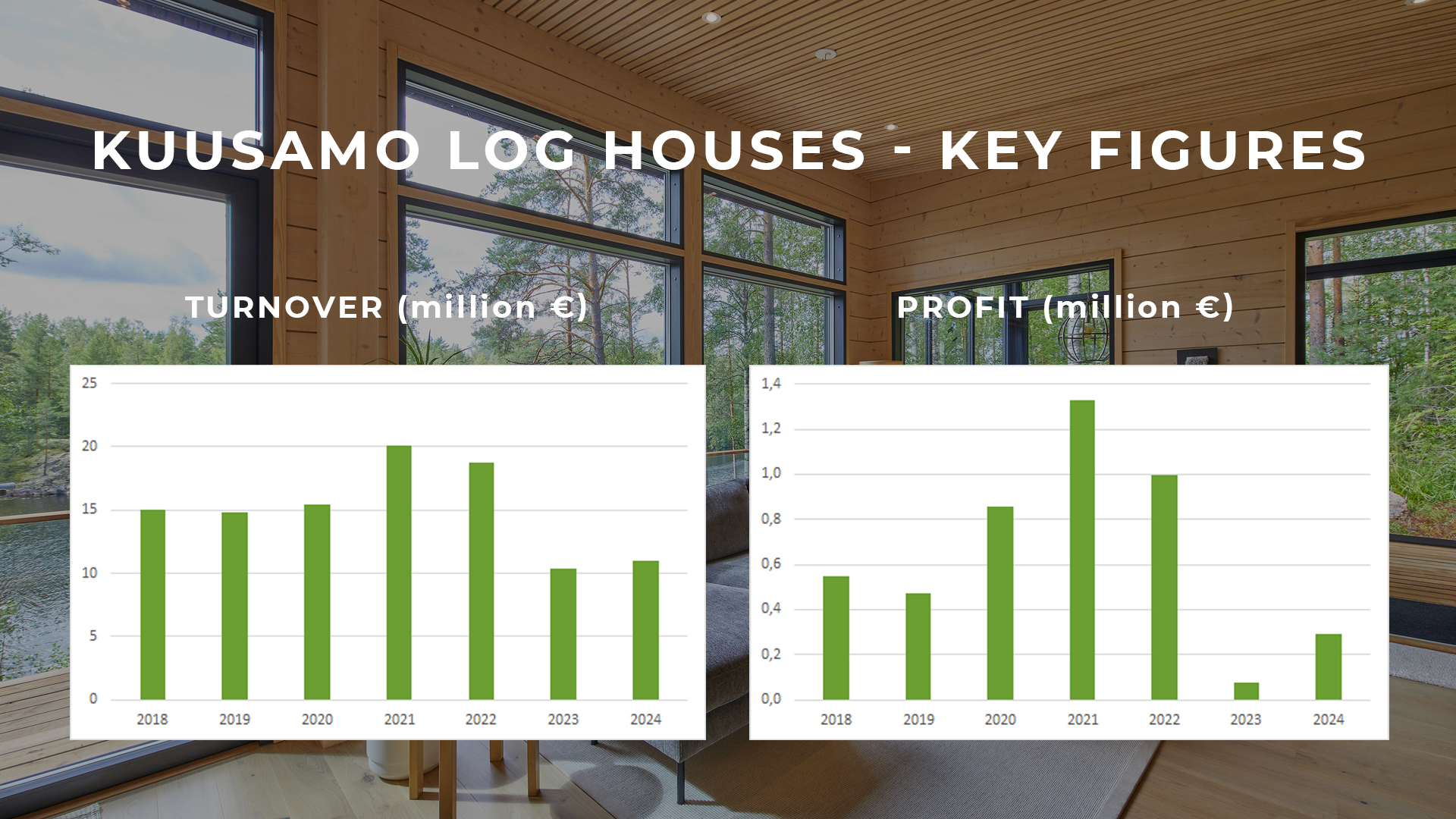

Kuusamo Log Houses' financial statements for 2024 have been finalized. The company recorded a turnover of EUR 11 million and an operating profit of EUR 292,000. Our operations continue to be financially strong and stable.

Steady Growth in Turnover and Profit

In 2024, Kuusamo Log Houses increased its turnover by 6% compared to the previous year, reaching EUR 11 million. The operating profit rose significantly to EUR 292,000, further strengthening our solid financial position.

Throughout its 26-year history, Kuusamo Log Houses has achieved a positive operating result every year, a testament to our careful financial management and dedication to sustainable growth.

– The growth in our turnover, combined with timely operational adjustments, laid the foundation for our positive result. I would like to thank our dedicated staff and skilled sales network for their excellent work throughout the year, says Arto Orjasniemi, Managing Director of Kuusamo Log Houses.

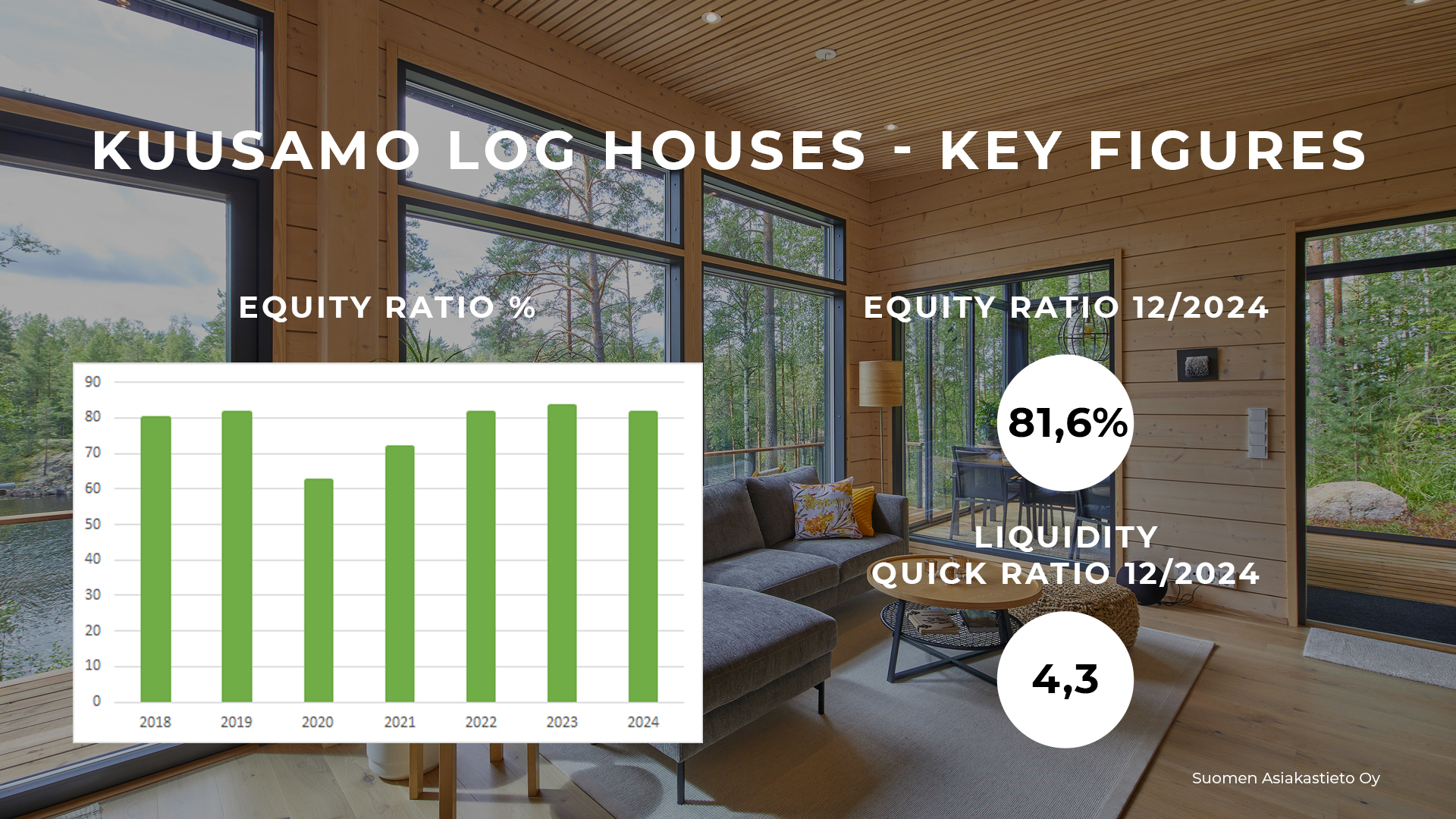

Key Financial Indicators Reflect Strength and Stability

Our company’s financial stability is well-illustrated by two key figures: equity ratio and liquidity.

According to Suomen Asiakastieto Oy, Kuusamo Log Houses’ equity ratio stands at 81.6%, continuing the strong trend of previous years. The quick ratio, measuring liquidity, is an excellent 4.3.*

– Our strong equity ratio and liquidity indicate that Kuusamo Log Houses has excellent capabilities to fulfill all its commitments now and in the future. Our substantial financial buffers also enable us to invest in development initiatives even after challenging market periods. This ensures that we remain a safe and reliable partner for our customers and collaborators, explains Arto Orjasniemi.

Future Outlook

Early 2025 has shown signs of modest improvement in the construction sector, and our expectations for the year are cautiously positive.

– We anticipate a slight growth in turnover this year. Our experienced and professional sales network in Finland remains a key strength, and we are also seeing signs of recovery in export markets, says Arto Orjasniemi.

– Despite the difficulties faced by the construction industry, our financial stability remains uncompromised. Kuusamo Log Houses continues to be one of the leading companies in the field. Our customers and partners can look to the future with confidence, Arto Orjasniemi affirms.

*Source: Suomen Asiakastieto Oy, April 16, 2025

What Do Equity Ratio and Quick Ratio Mean?

Equity Ratio

The equity ratio measures a company’s financial strength and its ability to withstand losses and fulfill long-term commitments. It indicates how much of the company’s assets are financed with equity rather than debt. According to Osuuspankki Bank, an equity ratio above 50% is considered excellent, and a ratio between 30% and 50% is considered good.

Quick Ratio

The quick ratio is a financial metric assessing a company’s short-term liquidity position. It shows how well a company can meet its short-term obligations with liquid assets, such as cash and easily realizable investments. A quick ratio over 1.5 is considered excellent, while a ratio between 1.0 and 1.5 is good.